Therefore income received from employment exercised in Singapore is not liable to tax in Malaysia. Shares bought and sold through stock brokerage accounts are subject to any income tax.

How To Invest In Us Stock Market From Malaysia 2022 Guide

This is because that income is not derived from the exercising of employment in Malaysia.

. The value of the s tock in trade at the end of a basis period is the same value as the stock in trade at the beginning of the following basis period. 13 December 2019. Since the market value of stock which was donated to the Ministry has been brought to tax the Company is eligible to claim the approved donation and set-off this against the aggregate income of the Company but restricted to a 10 threshold.

For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. Depending on how often you trade shares and how the Inland Revenue Board Of Malaysia IRBM classifies you you might need to pay tax on the profits or gains youve made or you could be eligible for a tax exemption. It is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale shares in a real property company.

The tax treatment for approved donation is applicable for the cost value of stock. Sales Tax Rate in Malaysia averaged 925 percent from 2006 until 2021 reaching an all time high of 10 percent in 2007 and a record low of 6 percent in 2015. Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income.

Capital gains arising from stock trading activities including ESOS are also not liable for income tax payments in Malaysia. 4 hours agoThat in turn has dragged yields on government bonds down from their highs of the year and given a boost to the stock market. Whether youre a trader or investor this guide explains how much.

122019 Date of Publication. However when it is frequent enough Inland Revenue Board IRB will treat it as an active income and do require income tax liability. You may need customised tax services if your present financial standing is a lot more complex.

Exchange gain of RM2000 that is attributable to the purchased trading stock which is the underlying transaction. A brokers online trading platform should let you enter orders and receive confirmations on your stock orders in addition to providing access to accurate stock quotes. The following foreign-sourced income received will continue to be exempted from Malaysian income tax from 1 January 2022 to 31 December 2026 5 years.

As such the value. THE government has made a surprising U-turn on Dec 30 2021 after announcing that foreign-sourced income received in Malaysia by Malaysian tax residents will be taxed. The clearest contrast is between kyy and Phillip.

For payments settled in the next financial accounting period please. Malaysia stocks fell on Monday as the government announced a one-off windfall tax on companies to raise revenue for the coming year. This page provides - Malaysia Sales Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

This trading software. 0 15 or 20 depending on your ordinary income. While there are no capital gains tax here has anyone declared trading profits as income or challenged IRB definition on badges of trade which may make trading profits as taxable income.

INLAND REVENUE BOARD OF MALAYSIA TAX TREATMENT OF FOREIGN EXCHANGE GAINS AND LOSSES Public Ruling No. Are profits from stock trading taxable in Malaysia. Returns made on a stock you owned for longer than a year are subject to the long-term capital gains tax rate.

Treasuries slipped to 2790 from 2848 Friday. Sales Tax Rate in Malaysia remained unchanged at 10 percent in 2021 from 10 percent in 2020. Tax rates shown here are for illustrative purposes.

The benchmark FTSE Bursa Malaysia KLCI index fell around 22. Its tax time again which means a couple of things if you trade shares in Malaysia. The yield on 10-year US.

Profit made on a stock you owned for a year or less before selling is taxed at the short-term capital gains rate which is the same as your usual tax bracket.

Dividend Taxes Malaysia Archives Dividend Magic

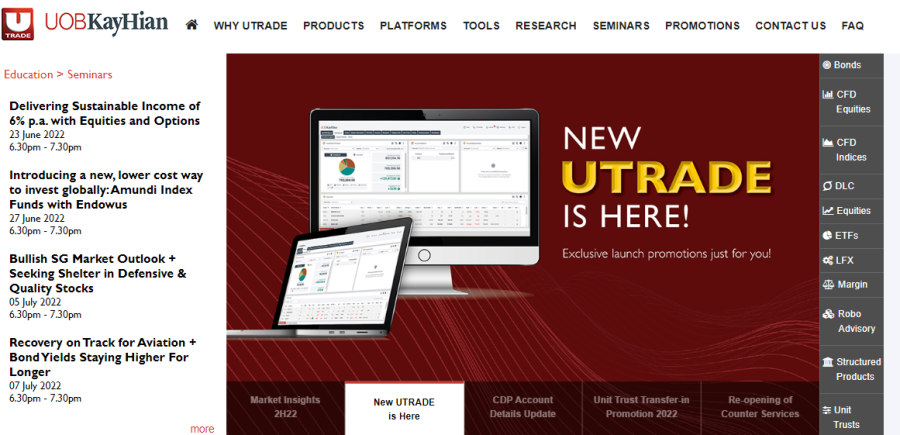

How To Buy Stocks In Malaysia In 2022

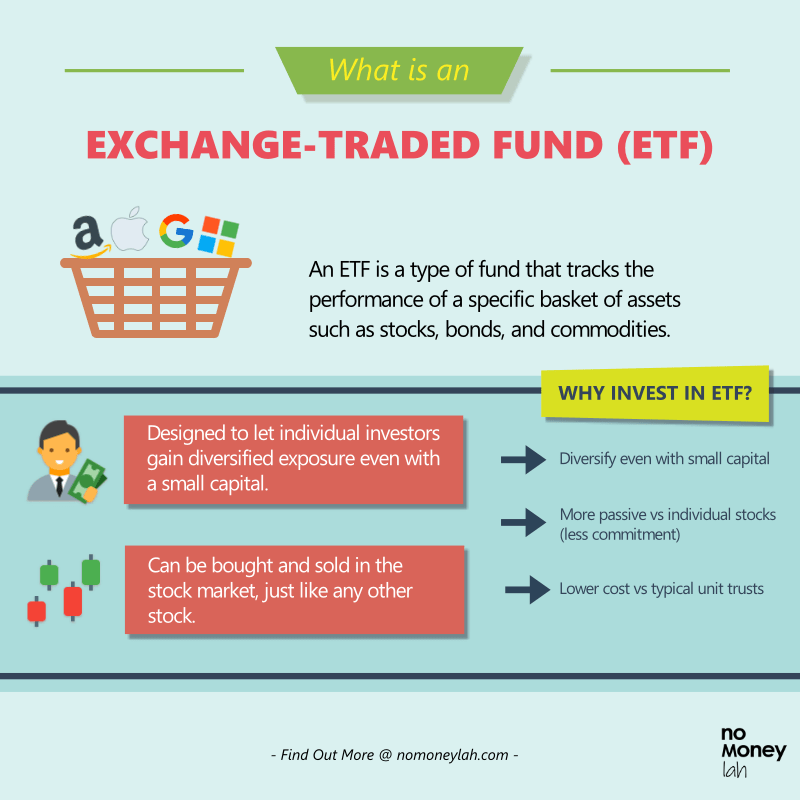

Malaysian S Guide To Invest In Etf No Money Lah

Bursa Malaysia Stock Tips With A Strategy Returns Bursasaham Stockpicks Tradingstrategy Hotstock Mal Fundamental Analysis Trading Strategies Investing

How To Buy Stocks In Malaysia In 2022

Withdrawal Of Stock Tax Risks Crowe Malaysia Plt

Esos What You Need To Declare When Filing Your Income Tax

Restricted Stock A Comprehensive Guide Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

How To Buy Stocks In Malaysia In 2022

How To Buy Stocks In Malaysia In 2022

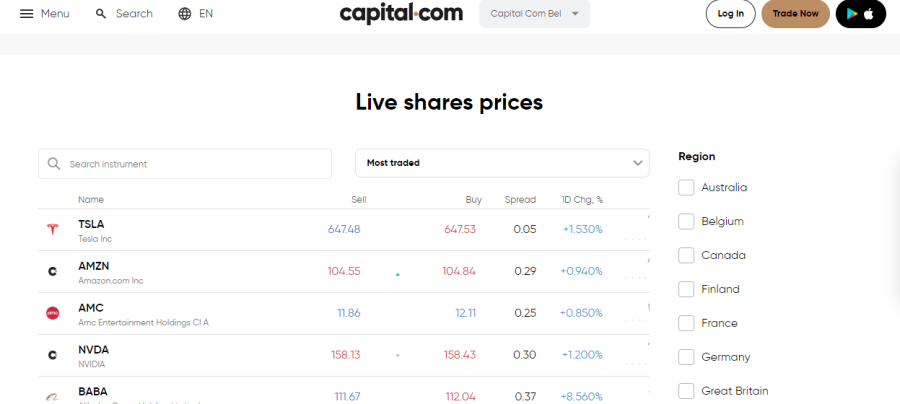

Top 7 Stocks To Buy In Malaysia Asktraders

Investing Making It Easier To Invest In Foreign Stocks The Edge Markets

How To Buy Stocks In Malaysia In 2022

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube